by John Spader and Patrick Kennedy

As published in RVBusiness January/February 2023

By now, most dealers are feeling the squeeze from all sides: slackening consumer demand, falling margins, slowing inventory turns, and rising flooring costs. Surely a different world than the one we have been operating in since 2020!

The timing of this sales cycle has been particularly difficult to manage. Desperate for inventory, many dealers bought as many good sellers as they could through much of early 2022 … but also a lot of inventory that they would likely not have ordered in a normal market. And as manufacturing capacity increased, lots – and flooring lines – were full by summertime. The result: a landscape of dealers with their highest inventory levels at precisely the time we are normally whittling it down to prepare for the new model year. Add in model year changeover plus some fluid pricing programs as manufacturers move their excess inventory, and we suddenly have a complicated inventory situation.

When business is good, or even average, it’s easy to lose sight of the basic math behind inventory turnover. Historically, only the best inventory managers in the industry managed to keep their annual turns around 3.0; most dealers languished in the 2.0 to 2.25 turn category. The sales momentum of the past couple of years gave hope that this slow turnover paradigm might finally have been broken, but early signs are that this is not the case.

If the next twelve months bring the same sales and margins of the last twelve months – not a given – the average dealer reporting to us already has six to eight months’ worth of inventory on hand, depending on their seasonality. Clearly too much!

The answer would seem to be straightforward – just stop ordering and everything will be fine, right?

Of course it’s not nearly so simple. Many factors come into play when considering stock orders: lead time, manufacturer incentives, planned promotions/shows, and inventory needed in peak selling months, to name a just a few variables. Inventory management is time consuming and complicated.

Still, however, it’s a mistake not to formulate a written inventory plan to make sure that you have a reasonable chance for a decent turnover in 2023. And the first step to a solid inventory planning system is a quality annual budget, with sales and expenses forecasted by month according to your seasonal trends. There is no overstating the importance of your annual budget to any serious inventory planning effort.

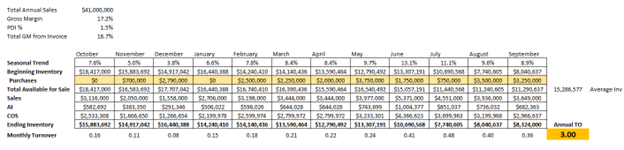

Once you have your forecast, however, it’s relatively easy to play this out on paper. Consider the following example:

Because we have a sales and margin forecast by month, it is possible to plug stock orders into the months they are scheduled to arrive and project the annual turn with accuracy. If a surprise opportunity comes up, it can be plugged in, and its impact on turnover can be projected in minutes. Without the budget, though, this level of accuracy is impossible, and we’re running the business on hunches and guesswork.

In a rising interest rate environment, a 2.0 or 2.25 annual inventory turn is going to leave many dealers scrambling to maintain profitability. Interest costs, curtailments, and aged inventory will all become cash flow and profitability challenges.

Dealers can avoid all of this by engaging in careful inventory planning. In a fast growing market, inventory planning is almost an afterthought. In a flat or declining market, it is the management habit that will make or break dealerships. Will you wing it in 2023? Or will you commit to a written inventory plan?