As published in RVBusiness, April/May 2023

Entrepreneurs are born optimists, especially RV dealers. Give them a vacant lot, they see a bustling sales floor. Show them an empty field, and they see an off-site show. An old warehouse? Why, a service facility of course. Dealers see what isn’t there yet and they create futures that wouldn’t otherwise exist, often with little more than guts and imagination. This industry was built by private entrepreneurs who saw opportunity and weren’t afraid to bet it all to turn opportunity into reality.

Unfortunately, this same spirit of adventurous optimism has also been the undoing of more than one dealership, usually through over-aggressive inventory purchasing.

2023 has the feel of one of those inflection points in the business cycle. High inflation, increasing interest rates, decreasing home valuations, and consumer fear of recession have all fed into an increasingly cloudy outlook for big ticket consumer goods. Dealers would be wise to think twice – or three times – before pulling out the PO book in 2023.

But how can we make sense of it all? If you look at 2022 as a whole, it certainly wasn’t a bad year by relative standards – sales and profits were still solid across almost every category. So should we plan on 2023 being a repeat of ’22? Or, with the mid-term elections over and signs pointing to an elusive “soft landing” in the economy, maybe dealers should assume that the bad news is behind us and plan for a positive 2023 scenario?

Fortunately, you don’t have to guess. If you have been tracking your sales for at least three years, you have a built-in forecasting mechanism right in your own data that could help provide a solid guide for 2023. What we want to know is what’s happening now, which we could all agree is very different than what was happening in early 2022.

Let’s take a look at some numbers to flesh this out:

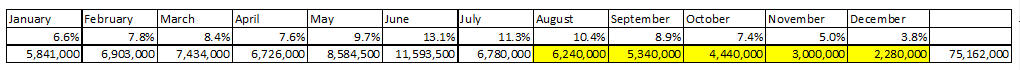

This is an example of 2022 total-company sales for an RV dealership. At first glance, it might be easy to just hit the repeat button and plan on another $75M year. But if you look closer, the numbers aren’t really indicating that level of volume in the coming months. Seasonal trends have long been used to project sales within a year, but if you consider your sales volume on a rolling basis, they also indicate where volume is headed perpetually. It is an axiom of seasonal trend calculations that we do not make any forward projections with less than 35% of any 12 months’ volume already completed.

If we look at this percentage of dealership’s sales, and count back adding up the trends, we need to go from December to backwards to August in order to get to 35.5%. Projecting from the sales of those months ($21,300,000 / 35.5%) forecasts a 12-month volume of $60,000,000 … taking this dealership all the way through its prime selling months. This is a very different scenario, with very different inventory and personnel needs. Yes, it sounds negative, but that’s what the numbers say in this case. And the good news is that you know it now, before the season starts so you can still plan to be profitable even at the reduced sales level.

For many dealers, the second half of 2022 was very different than the first half, as inventory started to build and, importantly, customer orders taken in 2021 were no longer priming sales numbers. If this describes your experience in 2022, consider doing the exercise above for your store to generate a more accurate projection for 2023. Forewarned is forearmed, as the saying goes, and this is another tool to provide insight into the coming year.